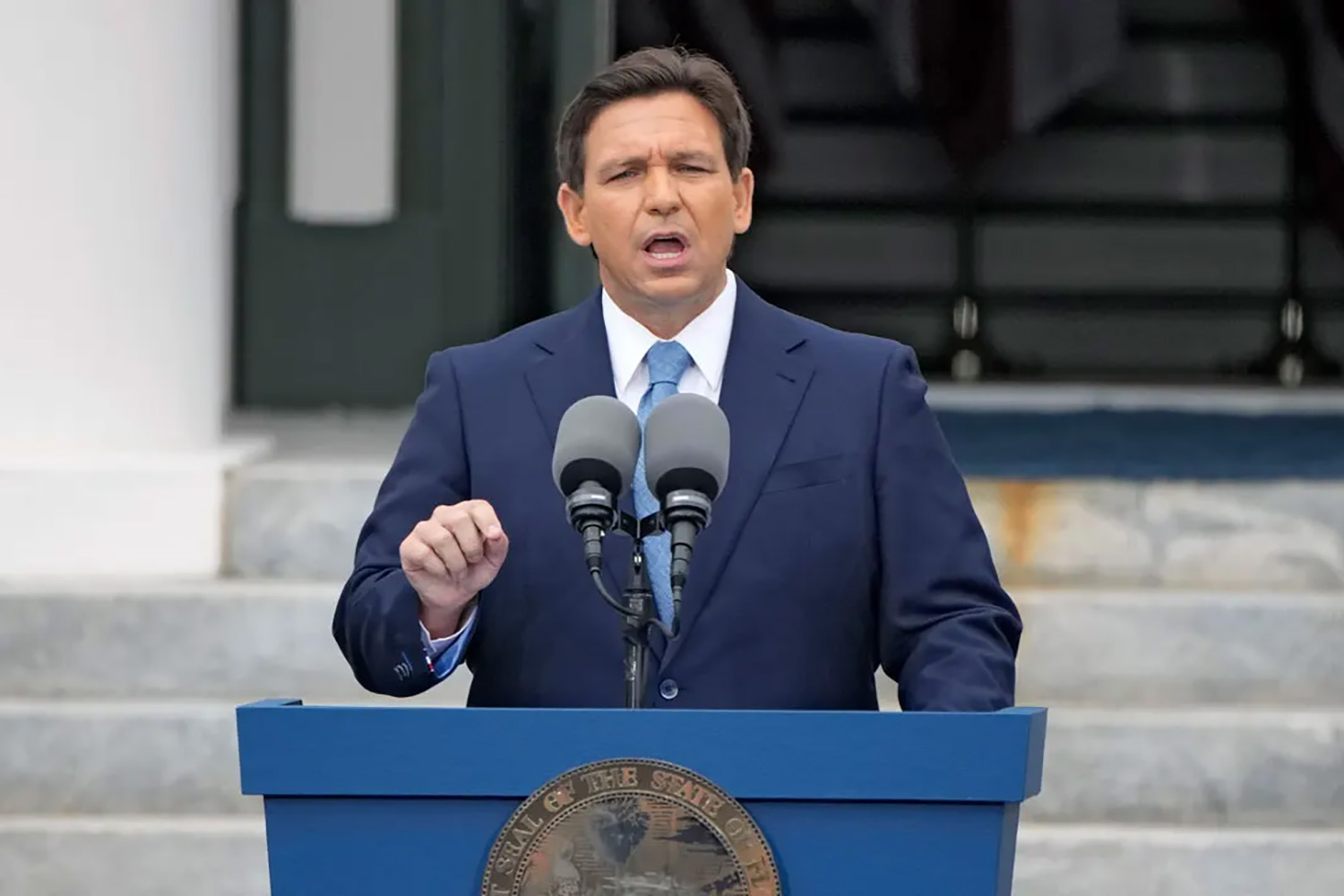

DeSantis helps Florida residents with Prescription Drugs

TALLAHASSEE, Fla. (AP) — Florida will seek to provide consumers more flexibility in buying prescription drugs and more information about their costs under a legislative proposal that Republican Gov. Ron DeSantis said Thursday January 12, 2023, he will ask lawmakers to approve. The proposal would further regulate prescription benefit managers, the go-betweens for health [...]